net operating working capital calculator

Ultimately this ratio shows how well a company is able to use its current operating assets and how able it is to make changes to accommodate both new opportunities and. In the above example as we can see the working capital.

Working Capital Requirement Wcr Agicap

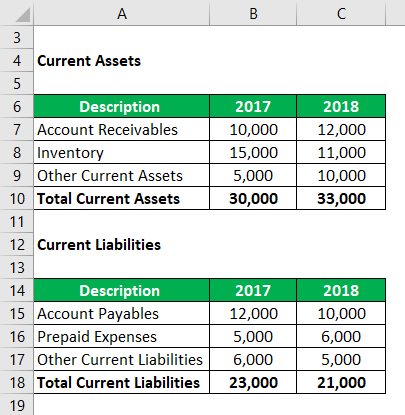

Calculate its Change in Net Working Capital.

. Subtract the companys current liabilities from its current assets for the most recent accounting period. Net Working Capital Current Assets Current Liabilities or Formula. Working capital 9328 million USD End.

Operating Working Capital 70000. Calculation of Days Working Capital is as follows. Formula Total Net Operating Capital Net Operating Working Capital Non-current Operating Assets Net Operating Working Capital Operating Current Assets.

Current Operating Assets 100000 Cash 75000 AR. Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts. This is evident in equation itself.

Operating Current Assets 25 million 40 million 5 million 70 million Operating Current Liabilities 15 million 10 million 5 million 30 million Upon netting those two values. How Does Net Working Capital Calculator Work. For example subtract 250000 in current liabilities from 350000 in.

With this information you can calculate NOWC by doing the following net operating capital calculation. You can use the following formula for calculating NWC ratio. Net working capital ratio is found by dividing current assets by current liabilities.

Net Working Capital Ratio. By using our smart working capital calculator we get. A positive net operating working capital number shows a company has the potential to adapt to an unexpected event or take advantage of a new business opportunity.

Net Working Capital is Calculated using Formula Net Working Capital Total Current Assets Total Current Liabilities Net Working Capital 36000 8000 Net Working Capital 28000. Net Working Capital Calculator Click Here or Scroll Down The formula for net working capital NWC sometimes referred to as simply working capital is used to determine the availability of. Cash Accounts Receivable.

The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. Working capital 900000 - 300000 600000 Working capital ratio The working capital ratio is calculated as the proportion of Current Assets against the Current Liabilities and. Working capital 31218 million USD Avg Working capital 20273 million.

NWC Total current assets total current liabilities Your total current assets are your cash assets plus accounts receivable. Net Working Capital is calculated using the formula given below Net Working Capital Current Assets Current Liabilities For 2017 Net. To calculate net working capital use this formula.

Net working capital ratio current assets - current liabilities and expenses total assets 2450000 - 1890000 3550000 560000 3550000 016 16.

Working Capital Definition Formula Examples With Calculations

Working Capital Cycle Operating Cycle Examples With Formula

Weighted Average Cost Of Capital Definition Formula Example

How To Calculate Working Capital With Calculator Wikihow

Operating Working Capital Owc Financial Edge

Nowc Net Operating Working Capital By Acronymsandslang Com

What Is Debt Service Coverage Ratio Free Calculator Included

Working Capital Turnover Formula And Calculator Step By Step

Net Working Capital Formula Definition Formula How To Calculate

Net Working Capital Nwc Formula Calculator Updated 2022

What Is Net Working Capital With Definitions And Formulas

What Is Net Working Capital Nwc In M A Software Equity Group

Change In Net Working Capital Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

Net Operating Working Capital And Cash Flow Download Table

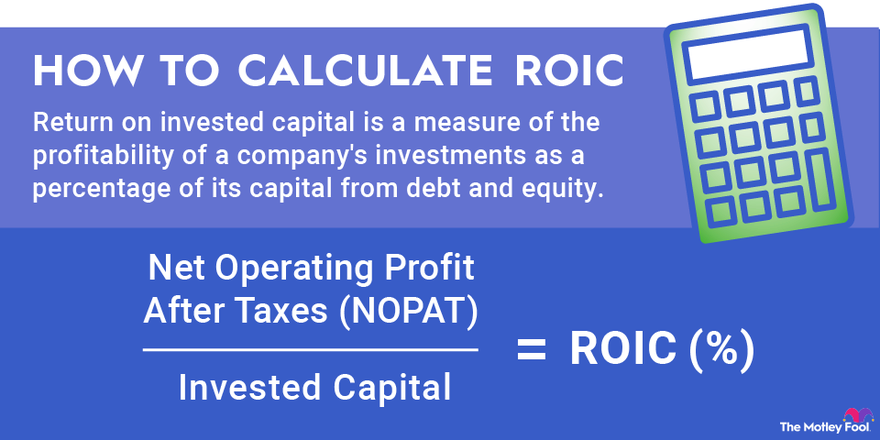

Return On Invested Capital Roic The Motley Fool

What Is Net Working Capital How To Calculate Nwc Formula

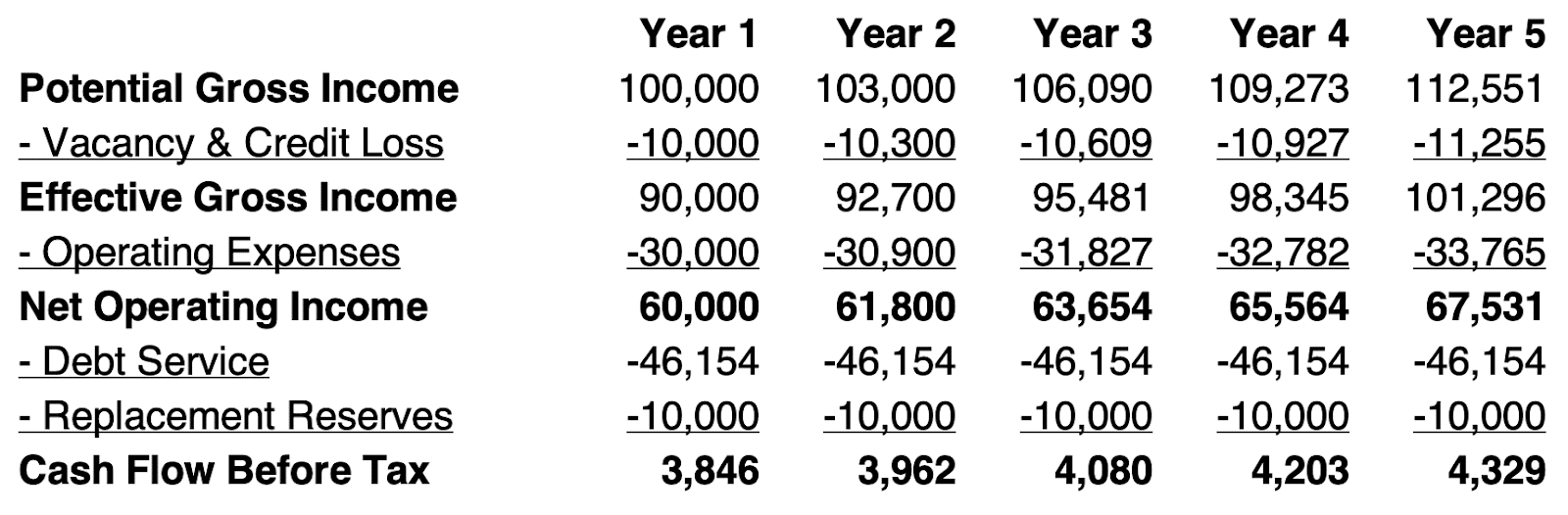

Net Operating Income Noi A Beginner S Guide Propertymetrics

Working Capital Turnover Formula And Calculator Step By Step